Upgrade Your HVAC Equipment to a More Energy Efficient System and Save For Years to Come...Don’t Forget the 2024 Tax Credits Alpharetta, GA

At Southern Home Performance, we understand that keeping your home or business comfortable year-round can come with high energy costs. That’s why we’re here to help you upgrade to a more energy-efficient HVAC system that saves you money while delivering optimal comfort.

Why Upgrade to a More Energy-Efficient HVAC System?

- Lower Energy Bills: Modern, energy-efficient HVAC systems are designed to consume less energy, which means reduced utility costs each month.

- Enhanced Comfort: These systems offer more consistent temperatures and better humidity control, ensuring you’re comfortable no matter the season.

- Environmental Impact: Energy-efficient systems use less power, helping reduce your carbon footprint and contributing to a more sustainable environment.

- Long-Term Savings: While the initial cost of upgrading may be higher, the long-term savings on energy bills will quickly pay off.

How We Can Help You Choose the Right System

1. Assessing Your Needs Every home or business has unique heating and cooling requirements. We’ll perform a comprehensive assessment to understand your space, existing system, and preferences to recommend the best options for you.

2. Selecting the Most Efficient System for You Whether you need an energy-efficient air conditioner, furnace, or a hybrid solution like a heat pump, we’ll guide you through your options, helping you choose the system that fits your needs and budget.

3. Optimal Sizing A system that’s too large or too small can lead to inefficiencies and higher costs. Our team will ensure your new HVAC system is the perfect size for your space, ensuring maximum efficiency and comfort.

4. Rebates and Incentives We’re also here to help you navigate potential rebates, tax credits, and special financing offers available to reduce the upfront cost of upgrading to an energy-efficient system.

Why Choose Us?

- Expert Guidance: With years of experience, our team can help you make informed decisions about upgrading to the best energy-efficient HVAC system.

- Professional Installation: We provide expert installation to ensure your new system operates at peak efficiency.

- Ongoing Support: After installation, we offer maintenance plans to keep your system running smoothly for years to come.

Upgrade your HVAC system today and start saving on your energy bills! Contact us now to schedule a consultation and find the perfect energy-efficient solution for your home or business.

Don't Forget About the Tax Credits

Key 2024 Tax Credits for Energy-Efficient HVAC Systems

Residential Clean Energy Credit (25C)

Eligibility: Homeowners who install energy-efficient systems in their primary residences.

Credit Amount: This credit allows homeowners to claim 30% of the cost of installing qualifying energy-efficient equipment, including HVAC systems, up to $2,000 per year.

Qualified Equipment:

Heat Pumps (Air-source and Geothermal)

Air Conditioners and Furnaces that meet energy-efficiency standards.

Smart Thermostats that help optimize energy use.

Details: The credit is available through 2032, and starting in 2024, the credit can be used annually for improvements to energy-efficient equipment, not just as a one-time benefit.

Energy-Efficient Home Improvement Credit

Eligibility: Homeowners upgrading to high-efficiency systems, including HVAC units, insulation, and windows.

Credit Amount: Homeowners can claim a credit of up to $600 for individual energy-efficient improvements like HVAC systems, plus up to $500 for energy-efficient windows. The total combined credit for all home improvements is capped at $1,200 per year.

Qualified Improvements: These can include replacing or upgrading HVAC systems that meet the necessary efficiency standards.

Tax Credit for High-Efficiency Heat Pumps (Section 25D)

Eligibility: Homeowners installing qualifying air-source or geothermal heat pumps.

Credit Amount: Homeowners may claim 30% of the total cost, including installation, up to $2,000 for air-source heat pumps. Geothermal heat pump installations can qualify for a larger incentive under the residential clean energy credit, depending on the system.

Geothermal Heat Pump Tax Credit

Eligibility: Homeowners who install geothermal heat pump systems.

Credit Amount: You can receive a 30% tax credit for the total cost of installing a geothermal heat pump, which can include both the system and associated labor and installation costs.

Details: This credit is available through 2032 and can significantly reduce the upfront cost of geothermal system installation, which is more expensive but offers long-term savings due to its high efficiency.

Other Incentives and State Rebates

In addition to federal tax credits, many states, local utilities, and municipalities offer additional rebates, incentives, or tax credits for upgrading to energy-efficient HVAC systems. Be sure to check with your local energy provider or state government for any additional savings opportunities in your area.

Benefits of Tax Credits for HVAC Upgrades

Upgrading your HVAC system with energy-efficient models can help you save money in the long run on energy costs while reducing your home’s environmental footprint. The tax credits available in 2024 make this transition more affordable, ensuring you get both immediate savings on your tax return and long-term energy savings.

For more information and to explore available options, we recommend reaching out to a qualified HVAC installer or a tax advisor.

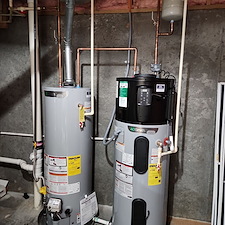

Project Image Gallery

Products Used

-

Heat Pumps, Air Handlers, Furnaces, A/C Units, Evaporator Coils, Water Heater Heat Pumps